flow through entity taxation

Estates and Trust Income Tax. Structuring the admission of the service provider.

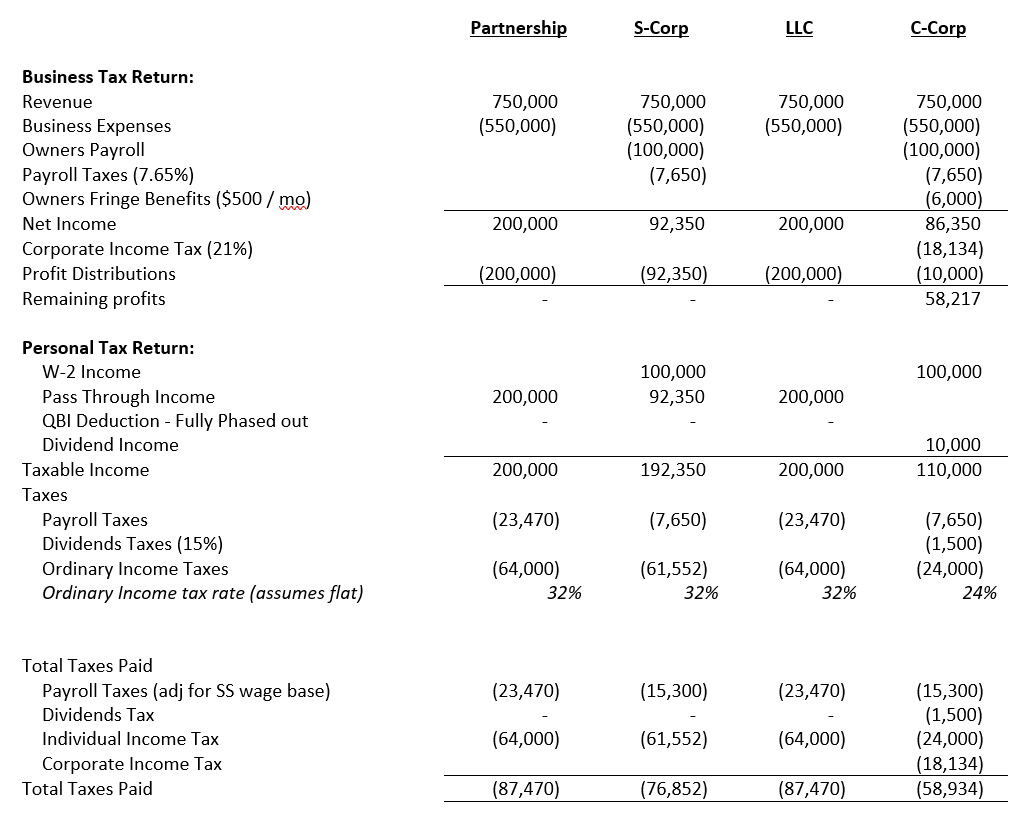

Pass Through Entity Definition Examples Advantages Disadvantages

This guidance is expected to be published in early January 2022 and will be posted to the Departments website.

. Instructions for Electing Into and Paying the Flow-Through Entity Tax Taxpayer Notice. The flow-through entity tax is retroactive to tax years beginning on and after January 1 2021. Flow-Through Entity Tax Payments Due by March 15 2022 To Create a Member Income Tax Credit for Tax Year 2021.

Understanding What a Flow-Through Entity Is. Virtually all states recognize traditional general partnerships and limited partnerships as flow through entities for taxation purposes. Instructions for Electing Into and Paying the Flow-Through Entity Tax.

Structuring the Flow-Through Entity. Every profit-making business other than a C corporation is a flow-through. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax.

Same facts as the example above except that the business is an. A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. 2018 5 2019-2025 10 2026 beyond 125 usually the 10 will begin to apply when payments to foreign affiliates exceed taxable income by more than 10 - BEAT does not apply to individuals S Corps RICs or REITs.

BEAT - Additional Rules. As a result only the individuals not the business are taxed on the revenue thereby avoiding double taxation. The continued levy of the tax is contingent upon the existence of the federal state and local tax SALT deduction limitation codified within IRC 164b6B.

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Flow-through Entity Tax Quarterly Estimated Tax Payments for Tax Years Beginning in 2021 Not Subject to Penalty or Interest.

Any flow-through entity making a 2021 election after the due date of the flow-through entity tax annual return March 31 2022. The income of the owners of flow-through entities are taxed using the ordinary. The income of the business entity is the same as the income of the owners or investors.

In the end the purpose of flow-through entities is the. Using qualified S corporation subsidiaries and single-member LLCs. A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests.

A flow-through entity is also called a pass-through entity. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Flow-through entities are used for several reasons including tax advantages.

City Business and Fiduciary Taxes. For further questions please contact the Business Taxes Division at 517-636-6925 and follow the prompts for Corporate. Utilizing partnerships and LLCs to solve S corporation structuring limitations.

Instead all income of the business is passed through to the owners who report it on their personal income tax return and pay taxes at their effective marginal rate. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated payments due for tax year 2021. This means that the flow-through entity is responsible for the taxes and does not itself pay them.

Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. City Business and Fiduciary Taxes. Eliminating C and S corporation penalty taxes by utilizing partnerships and other mechanisms.

Flow-through entities are considered to be pass-through entities. City Individual Income Tax. That is the income of the entity is treated as the income of the investors or owners.

Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence. Changes to 9-1-1 Under Senate Bill 400 PA 51 Filing Deadlines and Due Dates New Marihuana Retailers Excise Tax MRE Information Business Tax. Notice IIT Return Treatment of Unemployment Compensation.

The majority of businesses are pass-through entities. A flow-through entity FTE is a legal entity where income flows through to investors or owners. Because the business does not pay an entity-level tax pass-through entities avoid double taxation.

City Individual Income Tax. Common types of FTEs are general partnerships limited partnerships and limited liability partnerships. Instead their owners include their allocated shares of profits in taxable income under the individual income tax which is taxed as ordinary income up to the maximum 396 percent rate.

Common Types of Pass-Through Entities.

How To Choose Your Llc Tax Status Truic

Pass Through Entity Definition Examples Advantages Disadvantages

What Is A Pass Through Entity Youtube

Pass Through Entity Tax 101 Baker Tilly

Business Entity Comparison Harbor Compliance

Pass Through Taxation What Small Business Owners Need To Know

Pass Through Business Definition Taxedu Tax Foundation

What Are The Tax Implications For An Llc Effects Of Operating As An Llc

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

Flow Through Entity Overview Types Advantages

The Other 95 Taxes On Pass Through Businesses Econofact

Jp Magson Private Client Wealth Management

9 Facts About Pass Through Businesses

Choice Of Entity Choosing The Right Business Structure

Elective Pass Through Entity Tax Wolters Kluwer